Balassa-Samuelson effect

It has become conventional wisdom in economics that richer countries tend to have higher overall costs of living than poorer countries. Typically this is measured in terms of the real exchange rate, which compares the consumer price indexes of two countries converted to a common currency using the nominal exchange rate. This empirical observation has been referred to as the Penn effect, after the Penn World Tables data used tomeasure it, or alternatively as the Balassa-Samuelson effect, after the economists who wrote about the observation and endeavored to explain it. One important implication of this observation is that it indicates a systematic deviation from the theory of purchasing power parity, which is a building block in exchange rate theory. It indicates that there is a role for economic fundamentals such as relative income levels in explaining long-run real exchange rate behavior.Although numerous theories have been proposed over time to explain this systematic relationship between the real exchange rate and income levels, by far the most influential is that proposed in 1964 in two separate papers by Bela Balassa and Paul A. Samuelson. The theory is based on the divergence of productivity levels in a world of traded and nontraded goods, explaining that rich countries specialize in and produce goods that are characterized by higher productivity and that are easily traded internationally. (Because this basic idea is also found in an earlier book byRoy F. Harrod in 1933, the theory is sometimes referred to as the Harrod-Balassa- Samuelson effect. This entry will follow the convention of referring to the empirical observation and the theoretical explanation jointly as the Balassa- Samuelson effect.)

Many early empirical studies failed to find statistical support for the connection between relative prices and income levels. Itwas evenmore difficult to find statistical evidence of a linkage to the underlying causal factors that the Balassa-Samuelson hypothesis said should be at work, such as between exchange rates and relative productivity levels (see Officer 1982). It appears, however, that the strength of the Balassa-Samuelson effect has grown steadily over time. Recent statistical studies of the second half of the 20th century find that for a large sample of countries the relationship between relative national price levels and income levels became positive as well as statistically significant only in the 1960s, thus validating the Balassa-Samuelson hypothesis (for instance, see Bergin,Glick, andTaylor 2006). Itmay not be a coincidence that Balassa and Samuelson beganwriting on the subject at this time. Further, the correlation between these two variables appears to have quadrupled over the half-century since then, and it is very strongly significant statistically in current data.

The Theory of Balassa-Samuelson

How exactly are positive correlations between national price levels and income levels related to the Balassa-Samuelson effect? There is a specific way of explaining these correlations, based on differences in productivity levels across countries and goods. Here is a simple version of the theory with an intuitive example to follow.

Consider two countries, home and foreign, where foreign variables are denoted with an asterisk (*). Let there be two goods produced in these countries, where one good (t) can be traded internationally, and the other is a nontraded good (n). Traditional, albeit imprecise, examples of this distinction would be manufactured goods as traded and services as nontraded. For simplicity, suppose these goods are produced competitively in each country, using only labor as an input, with wages W and W* in each country.Denote the labor productivity in each sector as At and An at home, and At and An in the foreign country.

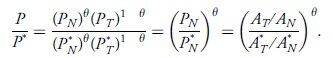

If one assumes that trade is costless for the traded good, its price will be equalized in the two countries. Conveniently, this also pins down the relative wage levels in the two countries, since W⁄At = Pt = P*t = W*⁄ A*t. The wage levels, in turn, pin down the nontraded goods prices with W⁄An = Pn and W*⁄A*n = P*n. Now construct a simple consumer price index, say, where the share of expenditure on nontraded goods in consumption is constant at the value y in both countries. Then the relationship between the price levels of the two countries is given by

This equation predicts that a country will have a higher overall price level if it is highly productive in traded goods, relative to its own nontraded goods, and relative to the traded goods of the foreign country. If one country is richer than the other, this higher income level can be due to higher productivity in the nontraded goods, the traded goods, or some combination of the two. The theory says that the larger the role of productivity growth specifically in the traded sector, the more likely it will be that high relative income levels will be associated with high relative price levels. On the other hand, if a country is richer due to higher productivity in the nontraded sector, or high productivity equally over both sectors, then the model will not predict that the rich countrywill have a higher overall price level.

As an intuitive and commonly invoked example of the Balassa-Samuelson effect atwork, suppose that the home country is rich because it is very good at producing a manufactured good like automobiles, but it has no productivity advantage relative to the foreign country in terms of a nontraded service like haircuts. The high productivity of home workers in the auto industry affords them a high wage. But it also requires that thewage be high for haircuts, or else no worker would be willing to provide this service, preferring instead to work in the auto industry. Given that a haircut requires the same amount of labor time in each country, but the wage rate paid to the haircutter is higher at home, it is clear that the price of haircuts will be higher at home. Since the purchase price of autos is the same across countries due to arbitrage through trade, the higher price of haircuts makes the overall cost of living higher in the home country.

Implications and Assessment of the Theory

The Balassa-Samuelson theory is used regularly by economists and policymakers to interpret a range of applied issues. Note that a straightforward extension of the theory fromlevels to changes would imply that countries with faster growth rates in the traded sector would have real exchange rates that are appreciating over time. For example, it predicts that China or other rapidly developing countries might expect pressure for their real exchange rates to appreciate as a natural counterpart to their rapid growth in productivity. Similarly, the theory predicts that if new accession countries joining the European Monetary Union experience a period of accelerated growth as they catch up to richer European countries, they likewise should expect pressure for real appreciation. Since a monetary union effectively implies that the exchange rate is fixed, this pressure should be expressed in this case as a higher inflation rate for countries with higher growth rates. The principle remains the same: higher rates of growth are associated with a rise in the relative cost of living.

The prevalence of the theory behind the Balassa-Samuelson effect in economics owes much to its elegant explanation of the basic price-income relationship. But it has received criticism for the assumptions needed to derive it. There is evidence that productivity gains, especially recently, are not limited to manufactured goods, but that the wealth of relatively rich countries is in part attributable to significant productivity gains in many services, such as information technology and retail. Furthermore, it also appears to be true that many services, especially information services, are becoming more tradable due tonewtelecommunications technologies.As changes in technology and transportation costs lead to significant changes in the volume of trade and even the types of goods and services that are most traded, it is not entirely clear what the future holds for the Balassa-Samuelson effect. See also equilibrium exchange rate; exchange rate forecasting; purchasing power parity; real exchange rate