Capital flight

- Measuring Capital Flight

- Significance of Capital Flight from Developing Countries

- What Causes Capital Flight

- Policy Responses to Capital Flight

Today’s world economy is characterized by large movements of capital across countries and regions. In this scholarship essay we will discuss the capital flight and the cross-border financial movements. Cross-border financial movements include legal transactions that are duly recorded in national accounts as well as the illicit smuggling of capital referred to as capital flight. Capital flight is the residual difference between capital inflows and recorded foreign-exchange outflows. Capital inflows consist of net external borrowing plus net foreign direct investment. Recorded foreign-exchange outflows comprise the current account deficit and net additions to reserves and related items. The difference between the two constitutes the measure of capital flight (Erbe 1985).

Measuring Capital Flight

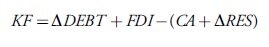

Capital flight (KF) for a country in a given year is calculated as:

where ΔDEBT is the change in total external debt outstanding, FDI is net direct foreign investment, CA is the current account deficit, and ΔRES is net additions to the stock of foreign reserves.

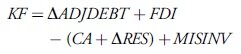

A number of refinements are made to the capital flight formula to obtain ameasure of capital flight to take into account the various channels and factors that affect capital flight. First, as countries’ debts are denominated in various currencies, the reported U.S. dollar value needs tobe adjusted totake intoaccount fluctuations in the exchange rates of these currencies against the dollar (Boyce and Ndikumana 2001). Second, trademisinvoicing constitutes an important channel of capital smuggling (Gulati 1987; Lessard and Williamson 1987). Export underinvoicing and import overinvoicing inflate the current account deficit recorded in the balance of payments, while import underinvoicing leads to understatement of the true deficit. Thus the capital flight estimate obtained using balance of payments trade data is likely either to overstate or understate the actual volume of capital flight. The refined measure of capital flight is the following:

where ADJDEBT is debt flows adjusted for exchange rate fluctuations and MISINV is net trade misinvoicing. Additionally, a measure of the opportunity cost of capital flight or the losses incurred by the country through capital flight is obtained by imputing interest earnings on capital that left the country in early years.

Significance of Capital Flight from Developing Countries

The problem of capital flight from developing countries deserves serious attention for several reasons. First, capital flight reduces domestic investment directly by reducing the volume of savings channeled through the domestic financial system, hence retarding economic growth. Second, capital flight affects the government’s budget balance indirectly by reducing the tax base through reduced domestic economic activity.Moreover, capital flight forces the government to increase its borrowing from abroad, which further increases the debt burden and worsens the fiscal balance. Third, capital flight is likely to have pronounced regressive effects on the distribution of wealth. The individuals who engage in capital flight generally are members of a country’s economic and political elites.They take advantage of their privileged positions to acquire and channel funds abroad. The negative effects of the resulting shortages of revenue and foreign exchange, however, fall disproportionately on the shoulders of the less wealthy members of society. The regressive impact of capital flight is compounded when financial imbalances result in devaluation of the national currency because those wealthy individuals who hold the external assets are insulated fromits negative effects, while the poor enjoy no such cushion. Fourth, capital flight exacerbates the resource gaps faced by developing countries and forces them to incur more debt, which worsens their international position and undermines overall economic performance.

What Causes Capital Flight?

The empirical literature has identified a number of factors that are associated with high levels of capital flight (Ndikumana and Boyce 2003; Murinde, Hermes, and Lensink 1996). The singlemost consistent finding in empirical studies on capital flight is that the annual flows of external borrowing are strongly associated with capital flight. The causal relationship between capital flight and external debt can run both ways: that is, foreign borrowing can cause capital flight, and capital flight can lead to more foreign borrowing. Foreign borrowing causes capital flight by contributing to an increased likelihood of a debt crisis, worseningmacroeconomic conditions, and causing a deterioration of the investment climate. This is referred to as debt-driven capital flight. Foreign borrowingmay provide the resources as well as amotive for channeling private capital abroad, a phenomenon called debt-fueled capital flight (Boyce 1992). Capital flight also induces foreign borrowing by draining national foreign-exchange resources and forcing the government to borrow abroad.

Good economic performance, measured in terms of higher economic growth, and stable institutions are associated with lower capital flight. Strong economic growth, for example, is a signal of higher expected returns on domestic investment, which induces further domestic investment and thus reduces capital flight. High and sustained economic growth also gives confidence to domestic investors about the institutional and governance environment of the country, which encourages domestic investment while reducing incentives for capital flight. The political and institutional environment is also an important factor in capital flight. In particular, political instability and high levels of corruption encourage capital flight as savers seek to shield their wealth by investing in foreign assets.

Policy Responses to Capital Flight

Private assets held abroad by residents of developing countries include both illicit and legally acquired assets. Different strategies are required to repatriate the two types of assets. Presumably, savers choose to hold legally acquired assets abroad to maximize riskadjusted returns. These assets will be repatriated as domestic returns rise relative to foreign returns. In order to prevent further transfers of resources abroad and to entice repatriation of legally acquired assets, therefore, governments in developing countriesmust implement strategies to improve the domestic investment climate.

Illegally acquired assets are held abroad not so much to maximize the returns on assets as to evade the law. Owners of these assets will be enticed by higher domestic returns only if they have guarantees of immunity against prosecution for fraud and penalties for unpaid taxes. Such guarantees, however, would have perverse incentive effects by rewarding malfeasance. Alternatively, these assets could be impounded and repatriated by force. However, the identity of the owners of capital that has been illegally smuggled out of a country can be difficult to obtain from the major financial centers, which have strong customer privacy legislation. In order to recover the proceeds of capital flight, therefore, developing countries will need the cooperation of the international financial centers and their governments. See also balance of payments; capital controls; capital flows to developing countries; foreign direct investment (FDI); international reserves; money laundering; offshore financial centers