Bailouts

- How Does the IMF Differ from Domestic Lender of Last Resort

- Debate Surrounding IMF Crisis Lending

- Has IMF Crisis Lending Been Successful

The term bailout could be applied to all loans provided for balance of payments support by the official sector. In practice, the policy debate over these loans focused primarily on the largest of these loans, and specifically those loans whose size exceeded the IMF’s traditional lending limits of 100 percent of quota in a year, or 300 percent of quota over three years. (A country’s quota determines the size of a country’s contribution to the IMF as well as its voting and borrowing rights.)The first prominent loan to breach these limits was provided in 1995 to Mexico. By the end of 2007, the IMF had provided ‘‘exceptional’’ levels of IMF financing to an additional eight emergingmarket economies facing acute balance of payments difficulties. Indeed, ‘‘exceptional’’ financing that is, financing in excess of the IMF’s normal lending norms effectively became the new norm for large emerging market economies that encountered balance of payments difficulties.

Using the size of an IMF loan relative to quota to distinguish between small and often uncontroversial IMF loans and those exceptionally large IMF loans creates some difficulties. First, the size of a country’s IMF quota maps only imperfectly to other relevant economic criteria Korea in 1997 and Turkey in 2001 and 2002 got exceptionally large IMF loans relative to their quotas, in part because their quotas were quite small relative to their current gross domestic product (GDP). Second, in several prominent cases, the multilateral development banks and the Group of 10 countries (a group of economically advanced countries) provided large amounts of financing alongside the IMF, so looking only at IMF financingmay understate the scale of official support. For example, the United States provided Mexico almost as much financing from its Exchange Stabilization Fund as the IMF and a group of bilateral creditors coordinated by the Bank for International Settlements (BIS) disbursed alongside the IMF in 1999. The World Bank and the AsianDevelopment Bank pushed by the United States provided a large amount of emergency financing to Korea, and Japan provided additional bilateral funds to Thailand (the bilateral ‘‘second-line’’ commitments included in the initial packages for Korea and Indonesia were never disbursed). Loans that breached the IMF’s own access limits also tended to be the largest loans whenmeasured by other criteria. Those countries that got large amounts of financing from other official sources also tended to get largeamounts of financing from the IMF.

How Does the IMF Differ from Domestic Lender of Last Resort?

An IMF loan to a country is in some ways similar to emergency financing from a domestic lender of last resort (typically, the country’s central bank). Both provide liquidity cash to those in need of it. Just as a loan from a domestic lender of last resort lets a troubled bank pay off its depositors, an IMF loan also lets some of the crisis country’s creditors ‘‘off the hook’’ by financing the repayment of the debt. Just as support from a domestic lender of last resort can convince a troubled bank’s creditors its depositors to give the bank time to try to work through its difficulties, international crisis financing can convince the country’s creditors to give it time towork through its problems.

But there are also important differences between the IMF and a domestic lender of last resort. First, the IMF’s lending capacity is constrained by theamounts members have placed on deposit with the fund. A domestic lender of last resort has no similar constraints, at least as long as it lends in the country’s own currency. Second, IMF loans are usually tied to policy changes, and inorder to encourage the country to implement those changes, IMF lending is rarely disbursed all at once; instead, IMF loans are usually disbursed in a series of tranches.Adomestic lender of last resort can provide all necessary funds up front. Third, the IMF does not lend against collateral; rather, crisis countries, by long-standing convention, pay the IMF even if they are not paying their other creditors. This allows the IMF to lend to crisis countries at modest rates without taking losses. Finally, many domestic bank ‘‘bailouts’’ do more than just provide a cash-strapped domestic bank with emergency liquidity. They also typically require giving a troubled bank a government bond a new financial asset to prevent depositors (and sometimes even the shareholders) in the bad bank from taking financial losses. International bailouts, by contrast, do not increase the net assets of a troubled emerging economy. The country’s external reserves rise, but so do its external debts. The international taxpayers who put up the money needed to make an IMF loan expect to get repaid in full.

Consequently the term bailout is perhaps too negative a term for emergency crisis financing, as it suggests that the crisis lender is picking up losses that otherwise would have been borne by the country and its creditors. The term rescue loan is probably too positive, however, as not all ‘‘rescues’’ have succeeded. Most neutral terms such as large-scale official crisis lending sound bureaucratic. The lack of an agreed term itself may be indicative of the ongoing debate about the wisdom of large-scale lending to crisis countries.

Debate Surrounding IMF Crisis Lending

Proponents of large-scale IMF lending argue that financial integration is generally beneficial. But they also recognize that it can increase the risk that a country with correctable policy problems can be forced into a disruptive default by a self-fulfilling crisis of confidence. Concerns that other external creditors will not roll over their short-term debts as they come due can lead all external creditors to demand payment as soon as possible. A country’s own citizens can also decide that they want to shift their savings abroad before the country runs out of reserves. Such a shift from domestic to foreign assets puts enormous pressure on the country’s reserves if it has a fixed exchange rate regime, on its exchange rate if it has a floating exchange rate regime, or on both reserves and the exchange rate if it has a managed float. Sergei Dubinin, the chairman of Russia’s central bank during the 1998 crisis, observed, ‘‘We can play games against the market, against the banks even, butwe can’t do anything if the entire population wants to change rubles into dollars’’ (Blustein 2001, 266 67).

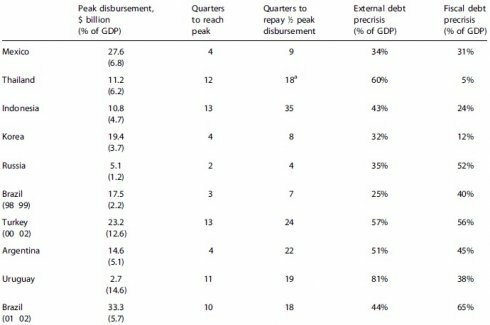

How quickly were IMF (and bilateral first line) loans disbursed, and how fast were they repaid?

Sources: IMF and bilateral first line lending data from IMF, U.S. Treasury; debt data from Moody’s (apart from Mexico’s precrisis debt data, which is from the IMF). Moody’s debt numbers for Brazil are higher than other sources. The IMF has Brazil’s 1997 (precrisis) debt to GDP at 35% rather than 40%; and Brazil’s 2000 (precrisis) debt to GDP at 49% rather 65%.

a Thailand’s IMF exposure peaked after 9 quarters, and it repaid half of that exposure after 17 quarters. At that point in time, it had not repaid 1/2 its bilateral lending. However, we do not have data indicating Thailand’s bilateral repayments after the end of 2001.

Such crises of confidence have usually stemmed at least in part from doubts about a country’s ability to put in place needed corrective policies, not just doubts about the willingness of other creditors to maintain their exposure. But as the run intensifies, a country can be pushed toward default well before it has time to show whether it can make the policy changes to ensure its long-run solvency.

Critics of large-scale lending have raised a host of objections. Some object to all official intervention in private markets. Official action that insulates a country and its creditors from paying the full price for their mistakes only encourages more bad policies and additional risk-taking so called moral hazard. Others object to the conditions attached to IMF loans, whether fiscal austerity, monetary tightening, or domestic financial and corporate reform. This criticism was particularly vociferous after theAsian crisis;many argued that the IMF’s conditions themselves contributed to the cascading loss of confidence. Many argued that the large bailouts of the 1990s and the first few years of the new millennium were a marked change from the 1980s, when the typical IMF loan was smaller (in relation to quota, though quotas were larger in relation to GDP) and was combined with commitments by the country’s largest creditors the commercial banks to roll over their claims.

Finally, some argued that the real problem was not that the IMF was lending too much, but rather that the IMF was not able to lend enough. The IMF risked providing enoughmoney to allow a lucky few to exit, but not enough to assure that the run would stop and the country would have time to put in place corrective policies.

This highlights a key point: in practice, even the largest IMF loans typically fell short of providing sufficient funds to cover all potential drains on the country’s hard currency liquidity. For example, Mexico received enough money to cover payments on the government’s maturing short-term dollarlinked debt, the famous tesobonos, but not enough to cover all potential sources of capital flight. Even a loan large enough to cover the most obvious sources of payment difficulties works only if additional sources of financial pressure do not also materialize.

Has IMF Crisis Lending Been Successful?

Several large IMF bailouts achieved most of their intended goals.Mexico, Korea, and Brazil (in 1999) all avoided default, recovered market access relatively quickly, and paid back their official creditors quite rapidly. Eight quarters after the onset of their crises, all had paid back more than one-half of their initial loans (see table 1). Brazil, however, is less obviously a success thanMexico and Korea, as the rise in its debt levels during the 1998 99 crisis laid the foundation for its 2002 crisis. Brazil did not pay its 2002 bailout loan back in eight quarters in part because the large loan in 2002 came on top of an earlier loan in 2001. But it otherwise resembles the ‘‘success’’ stories: it fully repaid the IMF at the end of 2005, and its debt levels were coming down through the end of 2007. Other rescues achieved their goals, but not as quickly. Thailand (1997), Turkey, and Uruguay all avoided default, regained market access, resumed growth, and eventuallymade significant payments back to the IMF. All these countries entered into their criseswith higher debt levels and generally have taken longer to repay the IMF than Mexico, Korea, and Brazil (particularly in 1999).

Three bailouts clearly failed to achieve their initial goals, however: Russia, Argentina, and Indonesia whether because the country failed to carry out its commitments to the IMF or because the IMF backed a flawed strategy. In 1998, Russia was cut off quite quickly, after one $5 billion disbursement from the IMF’s new program a decision prompted in part by the IMF’s substantial exposure from its previous lending programs. Indonesia received only $4 billion in the early stages of its crisis. Most of the funds it received from the IMF came later on, after its corporate sector had fallen into general default. Argentina, in contrast, received almost $15 billion in an unsuccessful attempt to ward off default.

By the end of 2007, the IMF had not approved a newlarge loan setting aside those loans extended to refinance existing IMF loans since 2002. In retrospect, the period of large-scale IMF lending that followedMexico’s crisismay be viewed as facilitating the transition of many emerging economies from a point where they held too few reserves to navigate periods of financial volatility to a point where most emerging economies held more reserves than they needed. During the turbulent period between 1995 and 2003, the size of IMF lending was striking. By 2005, though, the size of even the largest IMF loans seemed fairly small relative to the reserves of the typical emerging economies. For all the criticisms leveled at the IMF, most emerging markets concluded that they needed to hold far more reserves than the IMF was ever willing to make available. See also asymmetric information; bail-ins; banking crisis; capital flight; contagion; currency crisis; financial crisis; international financial architecture; international liquidity; International Monetary Fund (IMF); International Monetary Fund conditionality; International Monetary Fund surveillance; international reserves; lender of last resort