Corporate governance

- What Is Corporate Governance and Why Does It Matter

- Corporate Governance Systems

- Typology of Legal Strategies for Protecting Investors

- Good Corporate Governance

What Is Corporate Governance and Why Does It Matter?

The importance of corporate governance has become increasingly recognized for companies’ and countries’ prospects (Claessens 2006). As a consequence, regulators and policymakers in many countries diagnose weaknesses in their legal regimes and propose new arrangements said to foster higher firm performance, greater entrepreneurship, and better developed capital markets. Recent audit-based scandals in Europe and the United States have prompted investors to pay more attention to the institutions of corporate governance (Armour and McCahery 2006).Moreover, as allocation andmonitoring of capital among competing purposes and investments have become more complex, financial instruments, corporate structures, and accounting have all become more sophisticated and often more risky. This has made monitoring of management by shareholders and other stakeholders more difficult, involving higher costs. The other side of the coin, of course, is that firms with good governance will benefit through higher market premiums (Gompers, Ishii, andMetrick 2003).

Corporate Governance Systems

There are two main systems of corporate governance, which have significant differences: (1) the market-oriented corporate model, and (2) the relationship-based (or network-oriented) corporate system (Bratton and McCahery 1999; Roe 2003).

Market-oriented systems are characterized by dispersed equity holding through capital markets, a portfolio orientation among equity holders, and a broad delegation to management of discretion to operate the business. Two governance problems are said to result. The first is the shareholder management agency problem. Collective action problems prevent close monitoring of management performance by widely dispersed shareholders of small stakes. Imperfect performance incentives result for managers, who may rationally sacrifice shareholder value to pursue their own agendas. Market systems address this management incentive problem with three corrective mechanisms: the hostile takeover, shareholder legal rights against management self-dealing, and the inclusion of outside monitors on boards of directors. The second productive disadvantage of themarket system is a time horizon cost that stems from shareholders’ tendency to rely on short-termperformance numbers. This problemhas been attributed to information asymmetries. Management has superior information respecting investment policy and the firm’s prospects, but this information tends to be soft or proprietary and therefore cannot credibly be communicated to actors in tradingmarkets. At the same time,market systems fail to provide clear-cut protections tomanagerswho make firm-specific investments of human capital, a failure due in part to these systems’ reliance on takeovers, proxy fights, and boardroom coups to control agency costs.

Market systems have countervailing advantages. Their shareholders can cheaply reduce their risks through diversification. Compared to shareholders in relationship-based systems, they receive higher rates of return on their investment.Market systems’ deeper trading markets facilitate greater liquidity. These capitalmarkets alsofacilitate corporatefinance, providingmanagementwith greater flexibility on the type and source of newcapital than do themarkets in relationship-based systems. More generally, they provide an environment relatively more conducive to management entrepreneurship, as reflected in increased investment in new technologies.

Relationship-based systems are characterized by a majority or near majority of stock held in the hands of one, two, or a small group of large investors who hold blocks of shares. Like market systems, relationship-based systems leave management in charge of the business plan and operations. But large block investments imply a closer level of shareholder monitoring (Becht, Bolton, and Ro¨ell 2003). In addition, the coalescence of voting power in a small number of hands means earlier, cheaper intervention in the case of management failure. The other primary benefit of relationship-based systems stems from the blockholders’ access to information about operations. This decreased information asymmetry permits blockholders to invest more patiently. The longer shareholder time-horizon, in turn, freesmanagement to invest for the longer term and creates a more secure management environment for firmspecific investment of human capital.

There are corresponding costs and benefits. Where the blockholder is a firm, internal agency costs can constrain its effectiveness as a monitor. Indeed, whatever the identity of the blockholder, its heightened oversight incentive does not appear to result in sharp oversight of management investment policy. Freedom to make long-term investments thus often means pursuit of growth in market share at the cost of suboptimal return on equity investment. Trading markets in relationship-based countries tend to be thinner and less transparent than in market-oriented countries. Meanwhile, the blockholders themselves forgo the benefits of diversification and, given the thin trading markets, the possibility of easy exit through sale. Finally, there is a shortage of loyalty. Blockholders, having sacrificed diversification and liquidity, extract a return in the form of private benefits through self-dealing or insider trading (Dyck and Zingales 2004). Legal regimes in network-oriented systems facilitate this quid pro quowith lax protection of minority shareholder rights and lax securities market regulation.The judiciary in network-oriented systems, unlike somemarket-oriented systems (which play amuchmore proactive role in shaping the actual contents of the corporate governance framework than in continental European jurisdictions), is more confined to interpreting the statutes and codes enacted by legislators (LaPorta et al. 1997).

Typology of Legal Strategies for Protecting Investors

There is a wide collection of strategies for protecting shareholders and creditors from expropriation bymanagers and controlling shareholders.A basic division is between two categories: (1) regulatory strategies, through which the law mandates the terms of relationships among principals, agents, and the firm; and (2) governance strategies, through which the law channels the ongoing articulation of the terms of corporate agencies (Kraakman et al. 2004). The strategies within each category are designed to provide different solutions to principalagent problems ex post or ex ante.

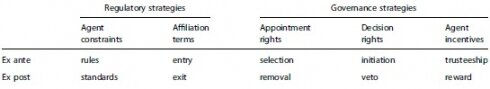

On examination, it turns out that there are two categories of corporate law that pursue regulatory strategies. The strategies in the first category impose performance mandates on agents. These agent constraints apply on an ex ante basis by rule and on an ex post basis through open-ended standards of conduct. The strategies in the second category govern the terms of the principal’s financial engagement with the firm. These affiliation terms apply on an ex ante basiswhen capital is transferred to the firmand on an ex post basis when capital is withdrawn or shares are sold.There are three other categories of corporate law measures that pursue governance strategies. The first category, appointment rights, concerns the ex ante selection of agents and their removal. The second, decision rights, concerns control over the terms of the firm’s governing contracts and its business plan. Ex ante decision rights control the initiation and amendment of investments, divestitures, contracts, restructuring, and corporate legislation; ex post rights go to the ratification or veto of investments, divestures, contracts, restructuring,andlegislation.The third set of governance strategies, agent incentives, concerns the incentives of the firm’s agents. Ex ante these relate to the agents’ qualifications as responsible fiduciaries; ex post they are related to the agents’ financial rewards. From this analysis ten categories emerge, which are given in table 1.

Regulatory and governance strategies. Table 1. Source: Kraakman et al. (2004).

A typology can be used to create indexes that capture the effectiveness of these five strategies to protect shareholders. The evidence shows that the strategy of giving shareholders strong legal rights in the appointment or removal of board directors has more measurable benefits for shareholders in common law countries such as the United Kingdom, which has tough rules on the removal of directors, than civil law regimes in continental Europe, where management has more discretion to address shareholder and creditor interests, and there are limited circumstances where a director can be removed. The evidence also points to potentially high benefits of shareholder involvement in corporate decisionmaking, such as in the case of directors’ remuneration. In the case of affiliation rights, the exit right of shareholders is addressed by corporate law strategies, developed albeit differently across Anglo- American jurisdictions, that effectively constrain management in frustrating a hostile bid and facilitate an exit right by ensuring shareholder approval of the bid. Changes in continental European takeover law to promote affiliation rights are still required, notwithstanding efforts by the European Commission to provide better constraints on target management in the Takeover Directive (McCahery and Renneboog 2003).

By comparison, the agent incentives strategies are often left to the contractual discretion of the board of directors. Codes of conduct set forth requirements in the area of board structure, the committee structure of the board, the role, monitoring and performance of the board and nonexecutive directors, and directors’ remuneration. Codes of conduct and stock exchange rules draw up highly specific requirements concerning conflicts of interests and transactions where shareholder approval is necessary. According to a recent study that measures the board’s independence fromlarge shareholders, the legal strategies that deal with constraining the board and giving shareholders more authority are more effective in Anglo-American jurisdictions than civil law countries. Meanwhile, the empirical studies that focus on the reward strategy are voluminous (see, e.g., Jensen and Murphy 2004). This line of research reveals a number of problems in the design of appropriate criteria that link shareholder welfare to performance criteria for directors and managers (Bebchuk and Fried 2004).

The above typology suggests a broad approach to corporate governance: (1) market value is the principal measure of shareholder interest; (2) other constituents should be protected by contract and outside regulation; (3) ultimate control should rest with the shareholders; (4) managers should be obligated to manage in the interests of the shareholders; and (5) noncontrolling shareholders should be strongly protected. These organizing factors, and the five corresponding regulatory strategies that constrain major shareholders andmanagers, provide a sufficient basis for evaluating corporate governance systems in differing jurisdictions and regions.

Good Corporate Governance

In recent years, the increased focus on good corporate governance among academics, policymakers, and business leaders has given rise to investigations about how shareholders’ rights and judicial enforcement vary across countries. This work has led to discussions which show that specific legal rules and practices are necessary to run a business and maintain corporate governance. Furthermore it shows that the best practices vary across countries (LaPorta et al. 1997). The impact of legal rules and institutions may vary, for example, depending on the judiciary’s ability to quickly resolve disputes (Berglo¨f and Claessens 2004).

Similarly there is a growing awareness of how the variety of corporate governance arrangements and extralegal mechanisms are specific to firm type, industry sector, and sources of finance (Carlin and Mayer 2000). These findings suggest that a good corporate governance systemrequires, inter alia, legal rules that promote a system of disclosure and accounting and audit systems that function effectively to provide investors with timely and accurate information to make effective investment decisions. The key message for lawmakers is that the agenda for governance reform is broad and challenging, but delivering in the key areas will enhance performance (Black, Jang, and Kim 2006).

The positive impact of corporate governance can be felt not only on firm performance but also on the level of financial market development. Countries with better property rights and strong investor protection tend to have higher-valued securities and deeper capital markets. Enhanced creditorprotection rights are also associated with deeper and more developed banking and capitalmarkets. Recent theoretical and empirical work highlights that countries with better investor protection are also less vulnerable to external economic shocks. In the end, corporate governance can induce countries to adopt higher standards which can have a major impact on realizing their objectives. See also infrastructure and foreign direct investment; multinational enterprises