Balance sheet approach / effects

- Key Balance Sheet Concepts

- Taxonomy of Balance Sheet Risks

- Policy Implications

- Operationalizing and Extending the BSA

National authorities, market analysts, and the International Monetary Fund (IMF) traditionally have assessed the financial health of a country on the basis of flow variables, such as annual gross domestic product (GDP), the current account, and fiscal balances. Sudden and disruptive capital account crises in Mexico (1994 5), Southeast Asia (1997 8), Russia (1998), Turkey (2001), and Latin America (2001 2), however, called into question the capacity of such metrics to provide a full picture of an economy’s vulnerabilities. Signs of impending trouble in these countries might have been spotted earlier through a more careful look at mismatches between the stocks of a country’s assets and its liabilities; that is, by looking at imbalances within and between a country’s sectoral balance sheets. Additionally, once a capital account crisis has begun, changes in the exchange rate, interest rate, and other asset prices can propagate the crisis through their effects on the relative valuations of assets and liabilities within and between sectors.

The balance sheet approach (BSA) represents a framework for identifying stock-based vulnerabilities and the transmission mechanisms between sectors that can turn theseweaknesses into full-blowncapital account crises. Knowledge of sectoral balance sheet mismatches can aid policymakers in reducing vulnerabilities and identifying appropriate policy responses once a financial crisis unfolds.

Key Balance Sheet Concepts

The BSA is principally concerned with providing a comprehensive assessment of the currency andmaturitymismatches in a country’s assets and liabilities that can trigger large adjustments in capital flows. Whereas traditional flow-based analyses of an economy have focused on the gradual buildup of unsustainable fiscal and current account positions over a defined period, the BSA looks at imbalances in the stocks of assets and liabilities, such as debt, foreign reserves, and loans outstanding at a certain point in time. Although the two approaches are obviously interrelated, since stocks are the product of both flows and valuation changes, the BSA focuses on how misalignments in stocks can lead to the sudden changes in flows that presage liquidity and even solvency problems.

An application of the BSA begins by looking at a country’s consolidated external balance sheet; that is, its position vis-a-vis nonresidents. This consolidated balance sheet summarizes the external debts of a country’s public and private sectors relative to their external assets. The consolidated balance sheet’s level of aggregation can, however, mask considerable imbalances between and within sectors that could trigger disorderly adjustments. For instance, a country’s consolidated balance sheet does not show foreign currency debt between residents, but such debt can trigger an external balance of payments crisis if the country’s government needs to draw on its reserves to roll over its domestically held hard currency debt. In fact, one of the key insights of the BSA is that cross-holdings of assets between residents can create internal balance sheet mismatches that leave a country vulnerable to an external balance of payments crisis.

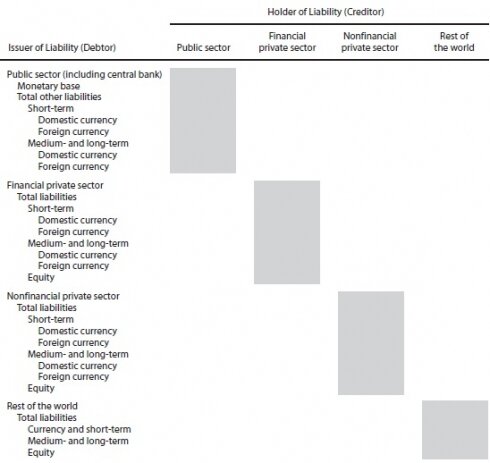

In order to implement the BSA, an economy can be disaggregated into a set of interlinked sectoral balance sheets. The exact disaggregation used should depend on the issues under analysis and the data available.Abasicmatrix of interrelated balance sheets would break down assets and liabilities by maturity and currency, and would include the public sector (i.e., central bank, government, and public corporations), the private financial sector (i.e., principally banks), and the nonfinancial private sector (i.e., companies and households), as well as an external (nonresident) sector to which all three of these domestic sectors are linked. Sectoral balance sheets are interrelated in that one sector’s liabilities are by definition the assets of another sector.

Intersectoral asset and liability position. Source: Rosenberg et al. (2005).

Real assets, such as plants and materiel, which are often a major element of public assets, are not included in a BSA matrix since they are not sufficiently liquid to be called on in a crisis. Consequently, a BSA style analysis provides a snapshot of an entity’s net financial position and its capacity to draw on liquid assets in response to pressure for repayment of its liabilities. It is not intended as a method for calculating the net worth or solvency of an economy or sector, nor does it serve as a precise early warning system. Rather, the BSA reveals vulnerability to a sudden rebalancing of stocks without necessarily providing an indication of the probability that such an event could occur. In this regard, even partial data can provide useful insights into potential vulnerabilities.

Balance-sheet mismatches do not in and of themselves lead to crises. They simply create the conditions underwhich a randomshock is likely to inflict damage on an economy. Maturity mismatches in Russia in 1998 left its balance sheets vulnerable to rollover and interest rate risks, but commodity price shocks and contagionfromtheAsiancrisiswere the actual triggers of the country’s crisis. Conversely, Lebanon managed to avoid a financial crisis through 2007 despite years of marked exchange rate, rollover, and interest rate risks connected to gross public debt levels in excess of 180 percent of GDP. Unwavering investor confidence proved an effective shield against real shocks.

The particular vulnerability of emerging markets to sudden capital flow reversals has dictated an early BSA focus on these countries by the IMFandmarket analysts.The approach is increasingly used, however, to examine specific vulnerabilities, such as asset bubbles and unfunded pension schemes, in both emerging and more mature market economies.

Taxonomy of Balance Sheet Risks

At least three major types of mismatch characterize the bulk of balance sheet risks:

1. Maturity mismatches. Mismatches between long-term, illiquid assets and shorter-term liabilities expose a balance sheet to risks related to both debt rollover and changes in interest rates. If liquid assets do not cover maturing debts, an economy or sector may be shut out of capital markets and unable to cover its debt-service liabilities. Similarly, a sharp change in interest rates can dramatically alter the cost of rolling over short-termliabilities, leading to a rapid increase in the cost of servicing debt.

2. Currency mismatches. A currency mismatch most often arises when a borrower’s assets aremainly denominated in domestic currency, but its liabilities are denominated in foreign currency, leaving the borrower’s balance sheet vulnerable to a depreciation or devaluation of the domestic currency. In many emerging markets, debtors have been motivated to borrowin foreign currency because it is often cheaper than borrowing in local currency. The choice to borrow in foreign currency is sometimes related to deposit dollarization: banks need to match deposits in foreign denominations with loans in the same currency, increasing their incentive to lend to unhedged local borrowers. Following Argentina’s crisis and default in 2001 2,many other highly dollarized countries in Latin America also experienced severe crises as a result of the pervasive currencymismatches created by their financial sectors’ need to match dollar deposits with dollar loans.

3. Capital structuremismatches. In the context of the BSA, capital structure refers to the balance between debt and equity in an entity’s financing. Comparedwith debt, equityprovides a naturalbuffer during times of balance sheet stress since dividends can be reduced along with earnings, whereas debt payments remain unchanged regardless of circumstances. Capital structuremismatches can arise when a country finances current account deficits through external borrowing (including from official sources, some of which can be difficult to restructure in the event of a crisis) rather than through foreign direct investment or portfolio equity flows.

These mismatches often combine to increase vulnerabilities. For instance,maturitymismatches in foreign currency can create difficulties if market conditions change and domestic borrowers do not have enough liquid foreign currency reserves to cover short-term foreign currency debt. This is what happened in Uruguay in 2002, when domestic banks had difficulties meeting a run on foreign-exchangedenominated deposits. Similarly, financial entities that borrow short-term funds to invest in longerterm debt instruments would suffer from a rise in interest rates brought about, for example, by an exchange- rate defense or cyclical developments, as occurred in Turkey during 2001. Maturity, currency, and capital structure mismatches combined in the Asian crises of 1997 8. Prior to these crises, the Korean government had severely restricted foreign direct investment, and most capital inflows were financed through foreign-currency, shorter-maturity external debt. Similarly, Thailand’s tax regime favored corporate debt over equity, which, combined with an implicit nominal exchange rate peg, also led the Thai nonfinancial private sector to build up foreign-currency denominated debt with nonresident creditors.

When current and expected liabilities exceed assets, a country, sector, or individual entity may face insolvency. Public-sector solvency is often assessed by looking at the ratio of sovereign debt to GDP or to revenue (as a proxy for the government’s ability to service its debt). Similarly, a country’s overall solvency is usuallymeasured by the ratio of total debt to GDP or to exports. But such measures can indicate vulnerabilities only when combined with othermeasures of risk exposure and an assessment of related mismatches.

No single debt-to-GDP ratio indicates that a sovereign or balance of payments crisis is imminent. For instance, countries with identical debt-to-GDP ratios, but different currency and maturity mismatches, often face distinct balance sheetweaknesses. The recent literature on debt intolerance draws heavily on the BSA to explain why developing and emerging markets have tended to run into trouble at much lower debt-to-GDP ratios than advanced countries. On the asset side of the public balance sheet, this research has focused onweak revenue bases and poor expenditure control as probable explanations for such low sustainable public debt thresholds. On the liability side, the literature on ‘‘original sin’’ the inability to borrow long term in local currency highlights the vulnerabilities created by the predominance of foreign-currency debt in emerging markets’ public borrowing.

Policy Implications

The BSA can aid policymakers in preventing and resolving capital account crises. In support of crisis prevention, the approach systematically identifies balance sheet vulnerabilities and highlights sectors in which liquidity buffersmay be wearing thin. The Brazilian authorities, for example, were able to head off a recession following the devaluation of the real in 1998 by shifting balance sheet risks away fromthe corporate and financial sectors, which were exposed to currency risks, and toward the public sector, which was relatively stronger at that time.They did so by issuing foreign-currencydenominated, interest-rate-indexed sovereign debt. As overnight rates were hiked to defend the real, private domestic holders of these bonds stood to gain. The Brazilian operation also highlights the cost of such risk transfers: althoughithelped unhedgedfirms toweather the devaluation of the real, it burdened the public balance sheet for many years to come.

More generally, the BSA has guided policies to reduce vulnerabilities, such as building asset buffers (official reserves), promoting private-sector hedging instruments, strengthening banking supervision, conducting sound liability management operations, and where appropriate instituting flexible exchange rate regimes toreduce incentives forunhedged exposures. Once a country is in a capital account crisis, an awareness of balance sheet mismatches can help the authorities choose an appropriate policy response. The BSA can be useful in comparing, for example, the costs and benefits of letting a currency depreciate or of defending it with changes to interest rates.

Operationalizing and Extending the BSA

Ideally, an application of the BSA begins with the compilation of the data needed to complete the basic 44 matrix shown in figure 1. Central banks in some OECD countries currently prepare and publish such balance sheet analyses of their economies. In emerging markets, data for the public and private financial sectors are usually easy to obtain, while data for the nonfinancial private sector are often harder to pin down. When national statistics are lacking, information from the Bank for International Settlements and the IMF on a country’s international investment position can sometimes help in compiling the external position and deriving the rest of the matrix. In the context of its surveillance and program work, IMF staff has so far completed BSA-style analyses on more than 20 country cases. Furthermore, balance-sheet-related concepts underpin the IMF’s frameworks for debt sustainability analysis and the Financial Sector Assessment Program, a key tool for identifying vulnerabilities in countries’ banking sectors.

The basic BSA matrix can be further augmented by including off-balance-sheet items such as contingent claims and derivatives in the assessment of vulnerabilities. Additionally, a full assessment of the risks arising from balance sheet mismatches should factor in attempts to identify the likelihood of future shocks. See also banking crisis; capital mobility; contagion; currency crisis; currency substitution and dollarization; early warning systems; financial crisis; global imbalances; hot money and sudden stops; international liquidity; International Monetary Fund (IMF); International Monetary Fund conditionality; International Monetary Fund surveillance; international reserves; original sin; spillovers