Capital mobility

- Arbitrage Measures

- Quantity-Based Measures

- Savings-Investment Correlations

- International Risk Sharing

- Current Account Dynamics

- Actual Capital Flows

- Measures of Equity Market Integration

- Regulatory, Institutional, and Other Measures

- Going Forward

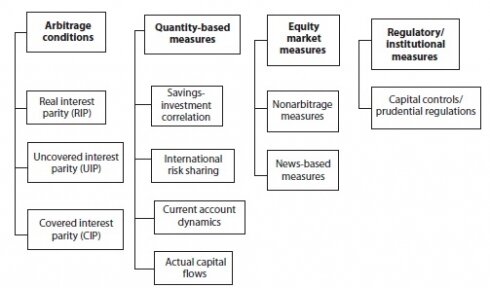

Capital mobility refers to the ease with which financial flows can occur across national borders. High capital mobility implies that funds are transferred relatively seamlessly from one country to another. Low capital mobility implies that financial capital does not flow as easily into or out of a particular country, and that theremay be barriers hindering the capital flow. In the world of international finance there are many types of financial flows, including foreign direct investment (FDI), portfolio flows, and flows processed through the banking sector. In order to capture the mobility of such a broad range of financial flows, economists use many different ways to measure capital mobility. No single measure will capture all the essential characteristics of capital mobility. The best results are probably obtained by using several measures together. This entry groups the many types of measures into four main categories: arbitragemeasures (for debt flows), quantitybased measures, measures of equity market integration, and regulatory / institutional measures (figure 1).

Arbitrage Measures

The first category refers to arbitrage conditions, which involve returns on debt instruments. These are largely embodied in the interest parity conditions: the covered interest parity (CIP), the uncovered interest parity (UIP), and the real interest parity (RIP). The basic idea behind parity conditions is that in a perfectly integrated financial market, investors will detect any gaps between the domestic currency return on a domestic asset and the domestic currency return on a foreign asset and will seek to close that gap. In other words, arbitrage should equalize the prices of identical assets traded in different markets that is, the law of one price holds and participants in the market will behave in such a way as to remove any differences in the exchange rate adjusted returns on assets in different markets. There are important differences between these measures: the CIP is the narrowest of measures; the UIP is a somewhat broader measure; and the RIP is the broadest of arbitrage measures. The arbitrage conditions seek to equate rates of returns of comparable assets across different markets/ economies. If capital mobility is high, then any differences in (exchange rate adjusted) rates of return will be alleviated through arbitrage in those markets. Hence, high capitalmobility implies that the various interest differentials will be low; perfect capital mobility implies a zero differential; while nonzero differentials suggest that there are barriers to capital flows.

Arbitrage conditions are probably a more appropriate way of measuring integration for certain sectors, such as banking, than for the whole economy. The perennial problem with using such arbitrage measures, especially in developing economies, is the question of what interest rate to use, and to what extent the available interest rates are comparable across countries.

Categorizing measures of capital mobility: A simple framework Figure 1

Quantity-Based Measures

A growing body of literature has explored quantity-based measures of financial integration. These measures provide an alternative to the traditional arbitrage conditions as a way of measuring capital mobility. Four such measures include savings-investment correlations, consumption correlations, current account dynamics, and actual capital flows.

Savings-Investment Correlations

Feldstein and Horioka (1980) pioneered the use of savings-investment correlations as a measure of capital mobility. The argument regarding savings-investment correlations is that ina closedeconomy,bydefinition, savings must equal investment (i.e., the correlation betweensavings and investment shouldbe veryhigh). At the other extreme, with highly integrated capital markets and a single world interest rate, domestic investment should be largely independent of domestic savings since the former can be financed through foreign savings. There are significant empirical and theoretical shortcomingswith the Feldstein-Horioka criterion and it remains a controversialmeasure of financial integration.The so-called Feldstein-Horioka puzzle is discussed in a separate entry.

International Risk Sharing

Although savings-investment correlations are the most popular quantity measure of financial integration, amore theoretically elegant measure is examination of consumption patterns within and across economies (Obstfeld 1989). Essentially, agents access capital markets to save or dissave based on how they wish to smooth levels of consumption over time. If two agents in different countries have similar consumption patterns, this implies that they use the same capital markets and that themarkets are equally accessible to both.More specifically, a high level of correlation of consumption between two economies is an indication that each country is accessing the same capital market to choose a time path for consumption that is outside the path implied by available domestic resources, thus implying access or openness to international capital flows.

The intuition behind tests of consumption correlations (‘‘international risk sharing’’) is that financial openness ought to afford individuals the opportunity to smooth consumption over time as they can borrow and lend on international financial markets. Thus consumption in any one country should co-move less with income over time, and if their preferences over consumption are similar, consumption should be correlated across countries. Conceptually, although consumption-based tests of capital mobility are attractive when attempting to discern whether a region is ready formonetary union (as the degree of business cycle synchronization may be less relevant as long as agents can share consumption risks across borders), they are based on a number of restrictive assumptions that limit their practical usefulness.

Current Account Dynamics

A related strand of the literature has focused on current account dynamics and, in particular, whether the current account is stationary (i.e., its mean and variance do not change over time). Simply put, the argument here is that if savings and investment are cointegrated (i.e., a linear combination of the two is stationary), their difference, which is the current account, ought to be stationary (Ghosh 1995). The problem with this line of reasoning is that a finding of stationarity could imply either that an economy is not financially integrated (thus suggesting the existence of a longrun relationship between savings and investment) or that the open capital market is imposing a solvency constraint on the country in the sense that the financialmarket will penalize a country that is viewed as being profligate by persistently running current account deficits (i.e., spending more than it is producing).

Actual Capital Flows

A fourth quantity-based measure of capital mobility is observation of the actualmagnitude of capital flows (FDI, portfolio flows, bank flows). All other things being equal, the higher the levels of capital inflows and outflows, the greater the level of capital market integration. Although examination of cross-border capital flows is useful in examining the composition of flows, insofar as there is no yardstick by which to gauge high versus low capital mobility, it tends to be of limited use as a measure of financial integration.

Measures of Equity Market Integration

Another measure of the integration of international capital markets involves examining equity market returns. This measure essentially refers to those nonarbitrage price-basedmeasures that include stock market correlations (both direct correlations as well as the extent to which risky assets can be priced using the international capital asset pricing model), or news-based measures (i.e., the extent towhichinterest rates and other financialmarket variables are affected by common shocks versus country-specific ones).

Papers measuring nonarbitragemeasures examine the bivariate properties of the data and how movements in the equitymarkets in one country influence the series in another country. In general, the methodological applications range from simple correlations and covariances to value-at-risk-based approaches such as Granger causality and variance decompositions for the short-run analysis and vector error correction models and cointegration tests for the long-run scenario. Essentially, these approaches examine the effect of changes in stock markets in major financial centers (theUnited States, Japan, the United Kingdom, etc.) on local stock markets. In addition, the use of test of asset pricing models has gained popularity. Asset pricingmodels allowfor risk characteristics to be considered when evaluating market data for different countries. The variance of stock returns provides very useful information about the extent of capital mobility, in that a variance that decreases as the international portfolio increases would imply that correlations between markets are low enough for benefits to diversification to be realized. This is evidence against integration between these markets.

The news-basedmeasures tend to be analyzed in a multivariate setting. The objective is to test for the existence of common trends and common sources of variation among a group of markets. A single common trend, for instance, implies a high level of integration. The existence of country-specific sources of variation would imply the opposite.

Regulatory, Institutional, and Other Measures

The degree of capital mobility can also be measured by observing the extent to which a country has imposed capital controls. The types of controls that might be in place are numerous, including legislative control over deposit rates, restrictions on capital account transactions such as restrictions on term or currency, regulations relating to the entry and exit of foreign financial services, and exchange controls. An obvious limitation of these measures is the difficulty of obtaining good proxies tomeasure such barriers or regulatory impediments that prevent financial integration. A fundamental assumption with all indexes of capital controls is that the removal of capital controls may, in some way, result in a more financially integrated economy. A situation could exist, however, in which a country has very few capital controls and yet is not regarded as being integrated with other economies. This could be due to legal or political factors, cultural variables, business practices, or the economy’s simply not having been noticed by others as a potential place to export capital flow that is, it ‘‘escaped the radar’’ of the international financial community.

Going Forward

It is generally believed that innovations in communications and market access, including reduction in barriers to capital flows, have increased the extent of international capital mobility worldwide. Obtaining empirical evidence of this is difficult, however. There is no single measure of capital mobility. Each measure offers only a partial indication of the extent of integration. Given the multiplicity of definitions of capital mobility, an important area for future research would be to develop a multivariate methodology to reduce the multidimensionality of the concept of capital mobility to an operational univariate measure. It is equally important to undertake more detailed studies on the legal, institutional, and other barriers that hinder the free movement of cross-border capital. See also balance of payments; capital controls; capital flows to developing countries; convertibility; exchange rate forecasting; exchange rate volatility; Feldstein- Horioka puzzle; home country bias; interest parity conditions; purchasing power parity