Carry trade

The term carry trade, or currency carry trade, refers to trades in which funds are borrowed in a relatively low-yielding currency to invest in a higher-yielding currency. In the process, a ‘‘short’’ position is established in the low-yielding currency and a ‘‘long’’ position is created in the other currency. The degree of leverage depends on the amount of capital (or the required margins) put up against the borrowing in the relatively low-yielding currency. The borrower benefits not only from the difference in yields but, more important, from any favorable change in the exchange rate. In principle, carry trades can take place between any assets that offer different expected rates of return.This entry covers carry trades in currencies.

The considerable recent attention paid to carry trades reflects the judgment of some market analysts that these trades can significantly influence exchange rate dynamics. Surprisingly, however, there is little quantitative evidence on their importance. This, in large measure, reflects the opaqueness of the overthe- counter (OTC) markets in which the bulk of currency trading takes place, along with the difficulties of identifying the size of such trades frombalance of payments data. Much of the evidence on carry trades tends to be anecdotal and based on the assessmentsof currencymarket analysts orparticipants.

The possibility of systematically earning higher than-normal returns from carry trades is closely linked to whether foreign exchange markets are informationally efficient. Inanefficientmarket, such trades would not be expected to systematically produce above-average returns (adjusted for risk), and any abnormal returnswould be amatter of chance. Either because foreign exchange markets are not informationally efficient or on account of differences in view about the appropriate underlying equilibrium model of returns, the carry trade literature assumes that marketplayers seek to systematically earn superior returns.

Market Efficiency

The informational efficiency of financial markets refers to whether asset prices fully reflect all available information. The concepts of informational efficiency and rational expectations are closely related, and the term rational expectations is also used to characterize situations in which expectations (and markets) are informationally efficient.

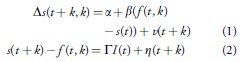

Since the move toward generalized floating in the early 1970s there has been an extraordinary amount of empirical work on the efficiency of major foreign exchange markets. For the most part, the work has not been successful in unambiguously determining whether major foreign exchange markets are informationally efficient. Largely because efficiency tests are joint tests of both informational efficiency and an assumed underlying model of equilibrium returns, statistical findings invariably are open to different interpretations. As applied to the foreign exchange market, a common assumption in many tests has been that interest-earning assets denominated in different currencies are perfect substitutes and carry the same expected rate of return (uncovered interest rate parity). Based on this assumption together with the assumption of covered interest rate parity, which allows the forward rate to be used as a proxy for the unobserved expected future spot rate many early tests considered whether forward exchange rates were biased predictors of future spot exchange rates (see equation [1]) or whether the difference between the realized spot rate and the lagged forward rate could be predicted on the basis of the available information set I(t) (see equation [2]).

Under the null hypothesis of market efficiency, the parameter α in equation (1) should be equal to zero and the parameter β equal to unity, while the error term should be white noise. Alternatively, informational efficiency can be considered with relation to equations such as (2) where depending on the assumed content of the information set I(t) the market is either weakly or strongly efficient when Γ = 0 and the error term is white noise. Here lower case s and ƒ refer to the natural logarithms of the spot and forward rates, respectively, I(t) is the information set at time t, u and η are error terms, and Δ is the first difference operator. The term ƒ(t, k)refers to the period t forward rate for period k.

Almost without exception, tests based on equations such as (1) and (2) have rejected the informational efficiency of foreign exchange markets under the maintained assumption of interest rate parity. In particular, a relatively robust finding across many major currencies and time periods sometimes referred as to the negative forward bias puzzle is that b in equation (1) is closer to negative unity than to positive unity as implied under efficiency. In addition, it is not uncommonfor available information including lagged values of forward and spot exchange rates to be found useful in helping predict the difference between forward and spot exchange rates in equations such as (2). In short, forward premiums appear to be biased predictors of future exchange rate changes and forecast errors tend to be predictable.

These findings are open to a number of different interpretations with regard to whether it is informational efficiency or uncovered interest rate parity that is rejected. Hence the underlying equilibrium model of returns is not conclusive. This issue has not been resolved, but recent tests of efficiency have increasingly moved beyond the assumption of uncovered interest rate parity to incorporate both constant and time-varying risk premiums. In addition, a number of studies have used survey data to measure exchange rate expectations in place of forward rate data.

Carry Trades and Exchange Rate Regimes

The extent to which large carry trades can be built up is likely to be influenced importantly by the exchange rate regime. Under a pure floating regime, uniformity in exchange rate expectations across agents would be expected to exclude the possibility of a very large buildup in carry positions. Negative sentiment toward a currency would be expected under floating rates to be reflected relatively quickly in adjustments in interest rates and exchange rates as individuals sought to builduptheir short-long currencypositions. As a result, risk-adjusted expected returns on assets denominated in different currencies would tend to be equalized. Any substantial buildup in carry positions under flexible exchange rates could arise when agents hold very different exchange rate expectations or there are differences in risk appetites. In such circumstances, one individual’s ‘‘long’’ carry position on a currency would bematched by an equal and offsetting position on the part of other individuals.

When there is substantial exchange market intervention and sterilization, the emergence of large carry positions seemsmore plausible. Such positions would represent bets of the private sector vis-a-vis the official sector about the future time path of the exchange rate.The positionswould be facilitated by the official sector intervening in the foreign exchange market and providing increased supplies of the currency inwhich the private sector sought to go ‘‘long.’’ Of particular interest in this latter connection are situations inwhich the buildup in ‘‘long’’ positions in a currency ismatched by the authorities’ sterilization of their exchange market interventions. In these cases, the long carry position of the private sector would effectively be matched by the authorities assuming the short position in the currency.

Carry Trades and Asia

Notwithstanding the large amount of attention paid to carry trades, the evidence of their importance in particular episodes is largely in the eye of the beholder. In analyzing the 1997 98 Asian financial crisis, international organizations such as the International Monetary Fund took the view (based largely on market intelligence) that carry trades had been important determinants of exchange market dynamics. Spurred by sterilized intervention that led to interest rates in many Asian emerging markets remaining well above those in the United States and Japan even as currencies were expected to appreciate, carry trades were seen as contributing importantly to the surge in short-term capital flows to the region before the crisis. Subsequently, the unwinding of these trades during the 1997 98 crisiswas seen as contributing to significant downward pressure onmany regional currencies.No attempt was made, however, to quantify the importance of these trades.

More recently, many market analysts expressed concern about a possible disorderly appreciation of the Japanese yen during 2006 related to a possible earlier buildup of large carry trades that had been funded in yen during the period when short-term interest rates in Japan were effectively zero. As the Bank of Japan began to raise interest rates in 2006, the possibility that these trades might be unwound led to concerns that the Japanese yen would appreciate sharply. In the event, the yen continued to remain weak even as short-term interest rates in Japan were increasedmodestly during the first half of 2006. Subsequently, there has been debate among private sector financial analysts as to howlarge the buildup in yen-funded carry trades during the zero interest-rate period had been and whether its importance had been exaggerated.

Carry trades can be viewed as one of a large number of ways in which individuals can speculate on currency movements. The absence of data on the quantitative significance of carry trades precludes a systematic evaluation of their potential importance, butmanymarket analysts regard themas potentially important influences on exchangemarkets dynamics during particular episodes. See also Bank of Japan; capital flows to developing countries; conflicted virtue; currency crisis; exchange rate regimes; exchange rate volatility; foreign exchange intervention; hedging; interest parity conditions; international reserves; peso problem; speculation; sterilization